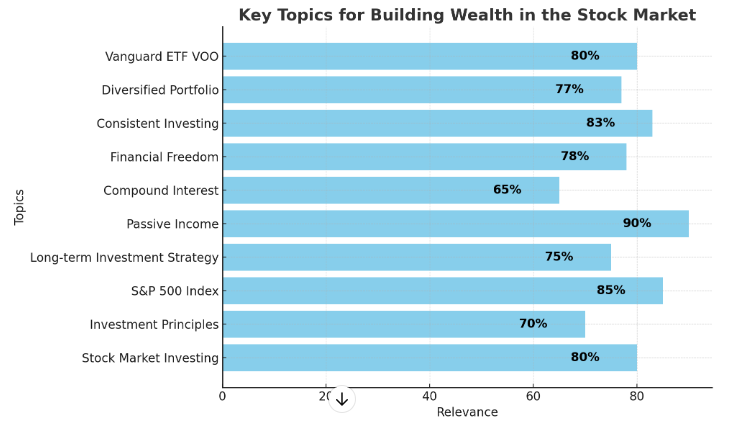

“Key Investment Principles: How to Build Wealth in the Stock Market”

Introduction

Investing in the stock market can be an exciting and lucrative experience, but it can also be risky if basic principles are not properly managed. My personal experience has been a roller coaster: I made a lot of money initially, only to lose it all later. After nine years of learning, studying at university, and watching many YouTube videos, I have identified a low-risk investment that has historically generated high returns: the S&P 500 index. But before investing in this unique opportunity, it is essential to master three key investment principles.

1. Don’t Cheat on Your Spouse: The Importance of Not Chasing Trends

Life Lesson:

Imagine being married to the woman of your dreams. One day, you feel attracted to another woman and decide to cheat on your wife. The satisfaction is temporary, and in the end, you lose your wife, who loved and cared for you. Similarly, in the stock market, chasing trends can result in significant losses.

Market Example:

In 2020, the market crashed due to the pandemic. In 2021, Bitcoin was booming, and many invested their savings, buying it at $64,000. When the price dropped to $18,000, the losses were devastating. In contrast, a stable investment in well-known companies like Costco would have generated much more solid and consistent returns.

2. Be Loyal to Your Spouse: Maintain Consistency in Your Investments

Life Lesson:

Your wife, whom you cheated on, loved you and stood by you through thick and thin. You didn’t value her, and when things got tough, you chose someone else. This mistake should not be repeated in your investments.

Market Example:

Instead of selling your stocks in moments of panic when prices drop, it is crucial to invest a fixed amount consistently each month. By doing this, you take advantage of price drops and buy stocks at lower prices, increasing your number of shares in the long run.

Investment Example:

If you invest $100 each month instead of a lump sum, you can acquire more shares at lower average prices. This disciplined and consistent approach leads to greater long-term benefits.

3. Have Children with Your Spouse: Build an Investment Portfolio

Life Lesson:

Having children involves great responsibility and long-term planning. Similarly, building an investment portfolio requires time, patience, and a long-term strategy.

The Power of Compound Interest:

Investing $7,000 annually from age 18 can result in $8 million by age 60. Compound interest makes your money grow exponentially. Even if you start at 40, you can achieve a comfortable retirement.

Recommended Investment: The S&P 500 Index

The S&P 500:

The S&P 500 includes the 500 largest and most profitable companies in the U.S., such as Microsoft, Apple, and Amazon. You cannot invest directly in the index, but you can do so through funds that replicate it, like the Vanguard ETF VOO.

Benefits of the S&P 500:

- Historical Returns: The S&P 500 has consistently outperformed many professionally managed funds.

- Diversification: By investing in a fund like VOO, you diversify your risk among the 500 largest companies in the U.S.

- Cost Efficiency: Investing in an S&P 500 fund is cheaper than buying individual shares of each company in the index.

How to Invest:

You can buy VOO on any investment platform. I use Webull, which offers tutorials and free shares when you open an account and make an initial deposit.

Investing smartly in the stock market requires discipline and a long-term strategy. By following the three basic principles of not chasing trends, maintaining consistency, and building a diversified portfolio, you can maximize your returns and achieve your financial goals. Join my exclusive financial community for Latinos and learn more about generating passive income, building credit, and much more.

I hope this guide is useful to you and motivates you to start your investment journey with a solid foundation and effective strategies!